After a car accident, one of the most important steps to take is to identify all available insurance coverage. You need to learn the full extent of insurance coverage to maximize your potential recovery. In the personal injury field, we use a form usually called an “Affidavit Of No Other Insurance” or “Insurance Affidavit.” But what is an affidavit of no other insurance? How does it work? Check out our video and the following blog post.

First: The Basics – Requesting Insurance Information

In every car accident case, you need to learn what insurance coverage is available to compensate you for your injuries. This is obvious. Does the negligent driver have $10,000 in coverage? $25,000 in coverage? $250,000 in coverage? Naturally, the amount of coverage impacts many things including, of course, your bottom-line recovery.

But how do you request insurance information?

In most cases, your personal injury lawyer will send a letter to the negligent driver’s insurance company requesting insurance information. Under Florida Statute Section 627.4137, when you request insurance information, the insurance company must provide certain information. This includes the negligent driver’s name, the insurance company’s name, and the policy limits.

But this leads to a question. How do we know the negligent driver disclosed all insurance information? Or are there other insurance policies that provide coverage?

Second: Utilizing The Affidavit Of No Other Insurance

After the negligent driver’s insurance company provides the insurance information, your insurance inquiry should not end.

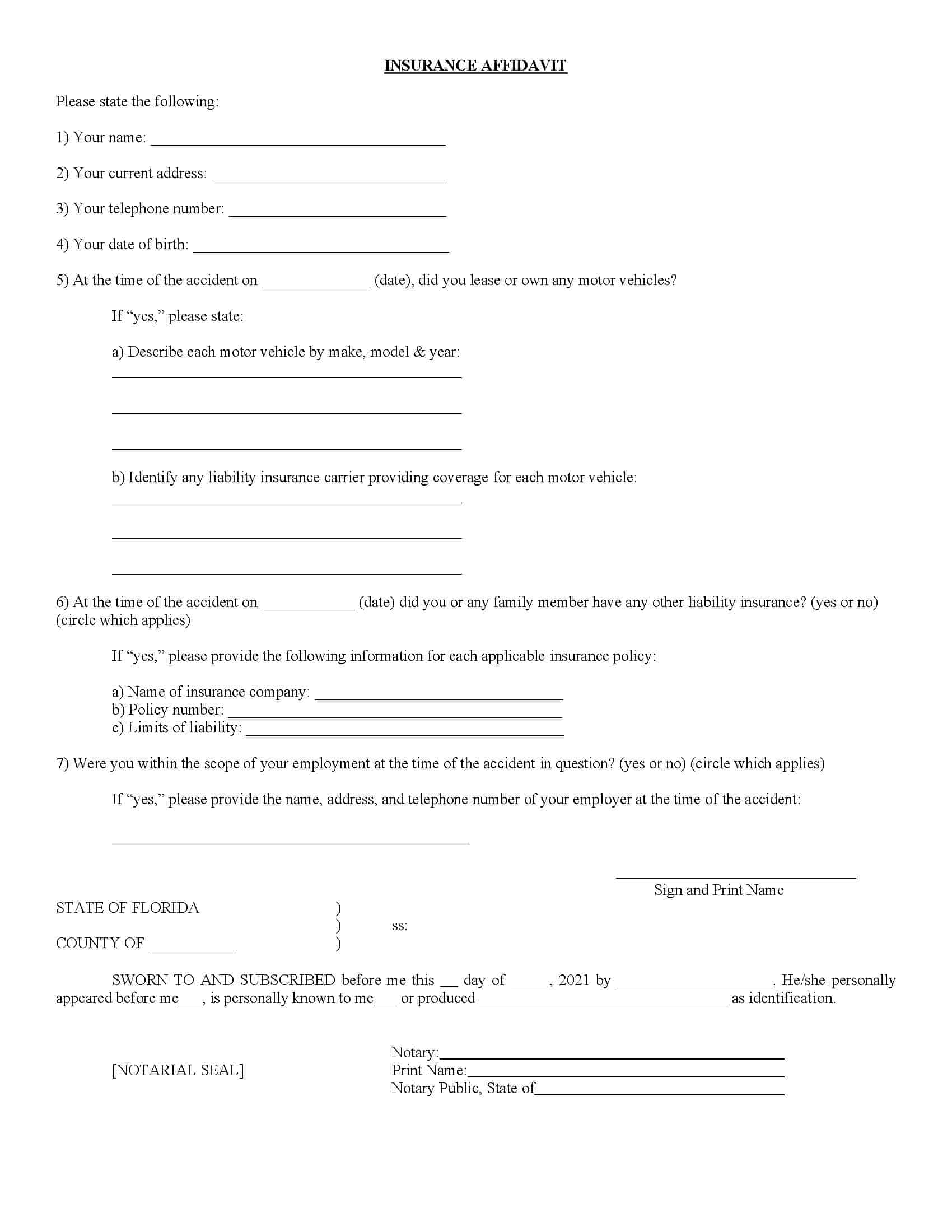

At this point, you should send the Affidavit Of No Other Insurance. What does it ask? Here’s a form I use in my practice:

Third: How The Affidavit Of No Other Insurance Works

As you can see, the affidavit requests the negligent driver to identify all of his or her vehicles and whether any potential family members have insurance coverage. Why ask for this information? Because in certain circumstances these other insurance policies may provide coverage for your loss. And if your injuries are serious, additional coverage may go a long way in ensuring you are protected financially.

Additionally, and as you can see, the affidavit requests the negligent driver to disclose whether he or she was in the course and scope of their employment during the accident.

Why does this matter? It matters for an important reason.

If the negligent driver was working at the time of the accident, his or her employer might be liable for the accident. This, in turn, means that the employer’s insurance coverage might apply to your accident.

In many cases, employers carry large insurance policies. This will be quite helpful if, again, your injuries are serious and your medical bills are large.

Fourth: How Do We Know The Negligent Driver Is Telling The Truth In The No Other Insurance Affidavit

If you are reading this post, you may be asking yourself: how do we know the negligent driver is telling the truth? What if he or she is withholding or hiding the existence of other insurance coverage?

Unfortunately, this possibility exists. A negligent driver may not want to disclose the existence of other insurance policies.

A good way to protect yourself against this is to include specific language in the settlement agreement with the negligent driver. For example, you can include language in the release that the settlement is void if you discover other insurance coverage. Or, as another example, you can include language that the settlement only applies to that specific insurance policy only.

While the insurance company may not agree to such language, you should include it in your release.

Barthelette Law

I hope this post answered your question: what is an affidavit of no other insurance?

Additionally, in certain car accidents it is common for plaintiffs’ attorneys to not only ask for an affidavit of no other insurance, but to also ask for a financial affidavit. Why ask for a financial affidavit from the negligent driver? Because in some cases you will want to see if the negligent driver can make a personal contribution from his or her own personal assets. To read more on financial affidavits in car accidents, click here.

If you have additional questions on insurance affidavits, do not hesitate to call us at (561) 246-4137 or contact us through our website here.

Drive safely!